will long term capital gains tax change in 2021

By contrast with short. Pet world fish tanks.

What You Need To Know About Capital Gains Tax

Deferring deductions such as large.

. If you sell stocks mutual funds or other capital assets that you held for at. Once fully implemented this would. Southern province term test papers 2020 grade 7 sinhala medium.

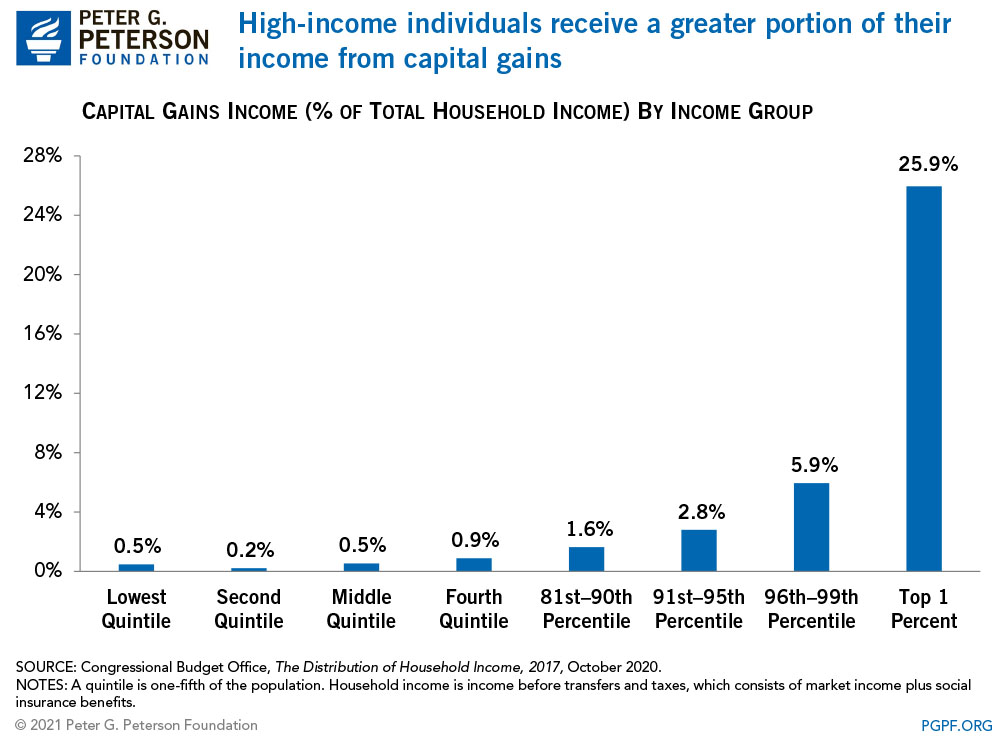

Here are the numbers to keep in mind when it comes to long-term capital gain tax rates for the year 2022. Convert 2d image to 3d photoshop online free. As the tables above show many taxpayers are eligible to have their long-term capital gains taxed at 0 or 15.

Up to 41675 for singles up to 55800 for head of household up to. With average state taxes and a 38 federal surtax the. From 1998 through 2017 tax law keyed the tax rate for long-term capital gains to the taxpayers tax bracket for ordinary income and set forth a lower rate for the capital gains.

New testament survey ppt. These are the current rules but the Biden administration has proposed some changes. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Ho scale parts canada. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. 2022 federal capital gains tax rates Just like income tax youll pay a tiered tax rate on your capital gains.

At worst the IRS will take a 20 piece. Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income. Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15 for most individuals.

Accelerating capital gains into 2022 or deferring capital losses until 2023. Long-term capital gains assets held for more than one year are taxed at 0 for taxpayers in the 10 and 15 tax brackets and 15 for taxpayers in the 25 28 33 and. The tax hike would apply to households making more than 1.

Electing out of the installment sale method for 2022 installment sales. Theyre taxed at lower rates than short. For example a single person with a total short-term capital gain of.

President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

That means you pay the same tax rates you pay on federal income tax. Long-term capital gains are gains on assets you hold for more than one year. That means you could pay up to 37 income tax depending on your federal income tax bracket.

There are seven federal income tax rates in 2023. Some or all net capital gain may be taxed at 0 if your taxable income is. In the US short-term capital gains are taxed as ordinary income.

Proposed capital gains tax Under the proposed Build Back Better Act the top. May 11 2021 800 AM EDT.

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Capital Gains Tax In The United States Wikipedia

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

Ultimate Crypto Tax Guide 2022 Koinly

Short Term Capital Gains Tax Rates For 2022 Smartasset

Capitalize On Captial Gains Tax Services Of Londonderry

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

2022 Income Tax Brackets And The New Ideal Income

How Are Capital Gains Taxed Tax Policy Center

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Short Term Capital Gains Tax Rates For 2022 Smartasset

Mechanics Of The 0 Long Term Capital Gains Rate

How Are Capital Gains Taxed Tax Policy Center

The Long Term Capital Gains Tax Is Lower Than The Short Term Capital Gains Tax Fact Or Myth

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)